Answer:

The correct option is |(45) = $41.54, P(45) = $319.52

Step-by-step explanation:

Loan amount = Price - Down payment = $25499 - $3240 = $22259

Monthly interest rate = i = 5.25%÷ 12 = 0.004375

Number of installments = n =72

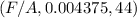

Monthly installment=$22,259 × (A/P,0.004375,72)

Calculating the interest factor;

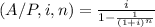

=

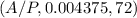

=

= 0.0162212

= 0.0162212

So,

Monthly installment=$22259 × 0.0162212= $361.0677

Now let us calculate the balance after 44th payment

B(44)= [$22,259 × (F/P,0.004375,44)] - [$361.0677 × (F/A,0.004375,44) ]

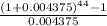

Calculating the interest factor;

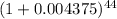

(F/P,0.004375,44) =

= 1.2117676

= 1.2117676

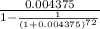

=

=

=

=

= 48.4040257

= 48.4040257

So,

B(44)= [$22,259 × 1.2117676] - [$361.0677 × 48.4040257] = $9495.6532

So, interest for 45th payment = I(45) = Balance due × Monthly interest rate

=9495.6532 ×0.004375

= $41.54

Principal associated with 45th payment=Monthly installment-Interest payment

=$361.0667 - $41.5435

= $319.5232

≅$319.52