Answer:

a) coupon payment:

10,000 x 3.375% / 2 = $168.75 per coupon

b) the rate of return is:

0.034034766 = 3.40%

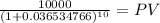

c) $7,155.6418

d) $9,588.7378

e) it would also decrease his value. To $ 6,984.9173

f) 10,000 / 9,588.74 - 1 = 4.29%

g) 9,588.74 / 6,984.92 - 1 = 37.27%

h) The zero bond coupon only considers the maturity value which is completely influence by the change in rate. The normal bond also has coupon payment which are less affected for the change in rate as they are spread over the life of the bond. The next coupon payment is only affected by 6 month not the complete 10 years period for example.

Step-by-step explanation:

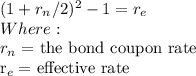

b)

(1+0.03375/2)^2-1 = 0.034034766

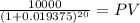

c)

Maturity 10,000.00

time 10.00

rate 0.03403

PV 7,155.6418

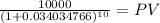

d) we recalcualte the present value considering the new rate

C 168.750

time 20

rate 0.019375

PV $2,776.0195

Maturity 10,000.00

time 20.00

rate 0.019375

PV 6,812.72

PV c $2,776.0195

PV m $6,812.7183

Total $9,588.7378

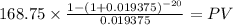

e)

Maturity 10,000.00

time 10.00

rate 0.03653

PV 6,984.9173