Given:

a.) The tax property assessed at $310,000 is $6,510

To be able to determine the tax rate on a $910,000 property, we will be applying ratios and proportions.

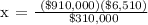

We get,

Where,

x = the tax rate

Therefore, the tax rate on the $910,000 property is $19,110.