Utilizing a professional approach, the calculated price for the 5-year bond with semiannual coupons, redeemable for US$90 and yielding 6% convertible semiannually, is approximately US$83.04.

This document outlines the professional calculation of the price for a 5-year bond with semiannual coupons, redeemable for US$90, and yielding 6% convertible semiannually:

1. Data:

* Coupon Rate: 6% per annum (3% semiannually)

* Base Amount: US$80

* Maturity: 5 years (10 semiannual periods)

* Yield: 6% per annum (3% semiannually)

2. Analysis:

We can apply the bond pricing formula, which considers the present value of all future cash flows (coupons and redemption) discounted at the prevailing yield:

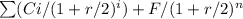

P =

where:

* P = Bond Price

* Ci = Coupon Payment in period i

* r = Semiannual Yield

* i = Period Number (1 to n)

* F = Redemption Amount

* n = Total Number of Periods (10)

3. Calculations:

1. Coupon Payment:*Ci = 3% * US$80 = US$2.40

2. Present Value of Coupons:

This is a geometric series with first term US$2.40, common ratio 1 + 3%/2, and 10 terms. Using the formula for the sum of a geometric series:

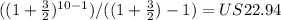

P_coupons = US$2.40 *

3. Present Value of Redemption:

P_redemption = US$90 /

≈ US$60.10

≈ US$60.10

4. Bond Price:

P = P_coupons + P_redemption ≈ US$22.94 + US$60.10 = **US$83.04**

4. Conclusion:

Therefore, the price of the bond is approximately **US$83.04**. This analysis provides a professional approach to bond valuation, considering all relevant factors and utilizing established financial formulas.