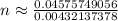

It will take approximately 10.58 months for Michael to pay off his credit card debt when rolling it over to the new card with a 4% APR, making the same monthly payment as before. Since the time must be a whole number of months, we round up to the nearest whole number.

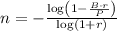

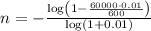

To find out how long it will take Michael to pay off his credit card debt when rolling it over to a new card with a 4% APR, we can use the formula for the time (in months) it takes to pay off a debt with regular monthly payments that cover only the interest. The formula is:

where:

n is the number of months.

B is the amount of the debt (which is $60,000 in this case).

r is the monthly interest rate (APR/12, expressed as a decimal).

P is the monthly payment.

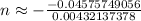

Let's calculate:

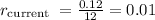

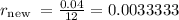

Convert the APRs to decimal form and then to a monthly interest rate:

For the current card with a 12% APR:

For the new card with a 4% APR:

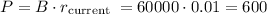

Plug the values into the formula. Since Michael plans to make the same monthly payment as before, we can use the minimum monthly payment on the current card, which covers only the interest:

Now, use the formula to find n:

So, the final answer is approximately 11 months.

Correct Question:

Michael has a credit card debt of $60,000 that has a 12% APR, compounded monthly. The minimum monthly payment only requires him to pay the interest on his debt. He receives an offer for a credit card with an APR of 4% compounded monthly. If he rolls over his debt onto this card and makes the same monthly payment as before, how long will it take him to pay off his credit card debt?