The correct option is c.

Project x5 is 82% complete with a gross profit of P792,000 due to exceeding earned revenue over incurred costs.

To calculate the gross profit (loss) of D on the project for x5 perform the following steps:

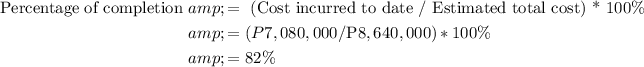

Step 1: Calculate the percentage of completion for the project.

The percentage of completion is calculated as the total cost incurred to date divided by the estimated total cost of the project. In this case, the cost incurred to date is P7,080,000 (P4,920,000 + P2,160,000) and the estimated total cost is P8,640,000. Therefore, the percentage of completion is:

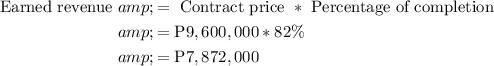

Step 2: Calculate the earned revenue using the percentage of completion.

The earned revenue is calculated by multiplying the contract price by the percentage of completion. In this case, the contract price is P9,600,000 (P9,600,000 + P480,000 change order) and the percentage of completion is 82%. Therefore, the earned revenue is:

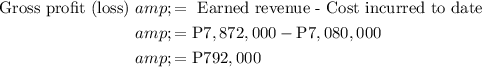

Step 3: Calculate the gross profit (loss) for the project.

The gross profit (loss) is calculated by subtracting the cost incurred to date from the earned revenue. In this case, the cost incurred to date is P7,080,000 and the earned revenue is P7,872,000. Therefore, the gross profit is:

Therefore, the gross profit on the project for x5 is P792,000.

The complete question is here:

D Company entered into a construction agreement in

for the riprapping of Pier 4 . The original contract price was

for the riprapping of Pier 4 . The original contract price was

but a change order was issued in

but a change order was issued in

increasing the contract price by P480,000. D uses the percentage of completion method of revenue recognition on long-term construction contracts. The following information are obtained on the project of x4 and

increasing the contract price by P480,000. D uses the percentage of completion method of revenue recognition on long-term construction contracts. The following information are obtained on the project of x4 and

.

.

The table is given below

What is the gross profit (loss) of D on the project for

?

?

a. ( P 960,000)

b.

c. (P 792,000)

d.