Final answer:

To reach their retirement goal, your parents must earn an annual interest rate of approximately 15.56%.

Step-by-step explanation:

To determine the annual interest rate your parents must earn to reach their retirement goal, we can use the compound interest formula. The formula is

, where A is the future value, P is the present value, r is the annual interest rate, and n is the number of years. In this case, we have P = $330,000, A = $1,500,000, and n = 15. We need to solve for r.

, where A is the future value, P is the present value, r is the annual interest rate, and n is the number of years. In this case, we have P = $330,000, A = $1,500,000, and n = 15. We need to solve for r.

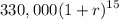

Plugging in the values, we get $1,500,000 =

. To solve for r, we need to isolate it. Divide both sides by $330,000:

. To solve for r, we need to isolate it. Divide both sides by $330,000:

= 4.54545455. Next, take the 15th root of both sides: 1 + r = 1.15562735. Finally, subtract 1 from both sides to isolate r: r = 0.1556.

= 4.54545455. Next, take the 15th root of both sides: 1 + r = 1.15562735. Finally, subtract 1 from both sides to isolate r: r = 0.1556.

Your parents must earn an annual interest rate of approximately 15.56% to reach their retirement goal.