Answer:

Step-by-step explanation:

1.

From the given information;

The spot rate for maturity at 0.5 year

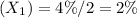

The spot rate for maturity at 1 year is:

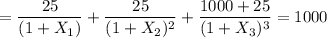

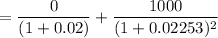

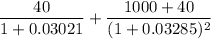

=

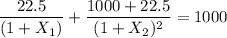

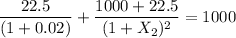

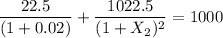

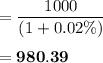

=

=

By solving for

;

;

= 2.253%

= 2.253%

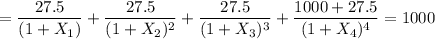

The spot rate for maturity at 1.5 years is:

Solving for

= 2.510%

= 2.510%

The spot rate for maturity at 2 years is:

By solving for

;

;

= 2.770%

= 2.770%

Recall that:

Coupon rate = yield to maturity for par bond.

Thus, the annual coupon rates are 4%, 4.5%, 5%, and 5.5% for 0.5, 1, 1.5, 2 years respectively.

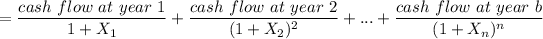

2.

For n years, the price of n-bond is:

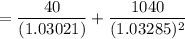

Thus, for 2 years bond implies 4 periods;

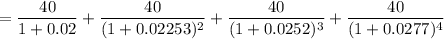

∴

= $1047.024

3.

Suppose there exist no-arbitrage, then the price is:

= 956.4183

Since the market price < arbitrage price.

We then consider 0.5, 1-year bonds from the portfolio

Now;

weight 2 × 1000 + weight 2 × 22.5 = 1000

weight 2 × 1022.5 = 1000

weight 2 = 1022.5/1000

weight 2 = 0.976

weight 1 + weight 2 = 1

weight 1 = 1 - weight 2

weight 1 = 1 - 0.976

weight 1 = 0.022

The price of a 0.5-year bond will be:

The price of a 1-year bond will be = 1000

Market value on the bond portfolio = 0.022 × price of 0.5 bond + 0.978 × price 1-year bond = 956.42

= 0.022 × 980.39 + 0.978 × 1000

= 956.42

So, to have arbitrage profit, the investor needs to purchase 1 unit of the 1-year zero-coupon bond as well as 0.022 units of the 0.5-year bond. Then sell 0.978 unit of the 1-year bond.

Then will he be able to have an arbitrage profit of $56.42

4.

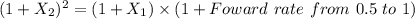

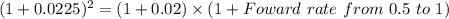

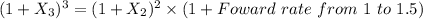

The one-period ahead forward rates can be computed as follows:

Foward rate from 0 to 0.5

= 2%

= 2%

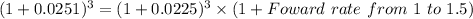

Foward rate from 0.5 to 1

Foward rate from 0.5 to 1 = 2.5%

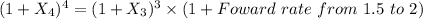

Foward rate from 1 to 1.5

Foward rate from 1 to 1.5 =3.021%

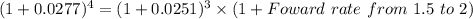

Foward rate from 1.5 to 2

Foward rate from 1.5 to 2 =3.021%

5.

The expected price of the bond if the hypothesis hold :

=

= 1013.724254

= 1013.72