Answer:

Explanation:

Formula

First part

As given

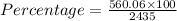

Paul's gross pay is $2435.

His deductions total $560.06.

Part value = $560.06

Total value = $2435

Putting the values in the equation

Percentage = 23%

Thus

The percentage of gross pay is 23% .

(As the percentage is always be 100% .)

The percentage of gross pay is take home = 100% - 23%

= 77%

Therefore the percentage of the gross pay is take home be 77% .

Option (D) is correct .

Second part

As given

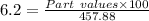

Chaya gross pay is $457. 88 .

The amount of Social security deducted is 6.2% of her gross pay.

Here

Percentage = 6.2 %

Total value = 457.88

As putting in the formula

Part values = $ 28.39 (Approx)

Therefore the deduction for social security cost be $28.39 .

Option (D) is correct .

Third part

As given

Jay earned $432.18 in net pay for working 32 hours.

Putting the values in the above

jay working hourly wage = 13.51 (Approx)

Therefore jay working hourly wage is $13.51

Option (B) is correct.