Answer:

deferred gross profit =$ 453,000

and realized gross profit is $453,000

Step-by-step explanation:

from the information given in the question , the required profit is related with deferred gross profit.

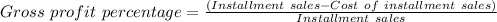

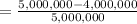

step 1 calculate gross profit percentage

= 20%

step 2 calculate deferred gross profit

deferred profit = (Total sales of installment - down payment ) × profit percentage

Deferred profit = 5,000,000 - 470,000 - 2,265,000) × 20%

where $2,265,000 represents 1st equal installment of remaining balance

deferred gross profit =$ 453,000

and realized gross profit is $453,000