Answer with explanation:

Formula for confidence interval for population mean ( if population standard deviation is unknown ) :

, where n= sample size

= sample mean

= sample mean

s= sample standard deviation

= two-tailed t-value for significance level of (

= two-tailed t-value for significance level of (

).

).

Let x denotes the amount of additional tax owed .

We assume that amount of additional tax owed is normally distributed .

As per given , we have

n= 64

Degree of freedom : df = 63 [ df= n-1]

s= $2595

Using t-distribution table ,

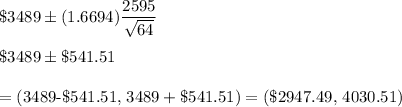

Then , 90% confidence interval for the mean additional amount of tax owed for estate tax returns would be :

1) The lower bound is $2947.49 .

2) The upper bound is $4030.51 .

Interpretation : We are 90% confident that the true population mean amount of additional tax owed lies between $2947.49 and $4030.51.