Answer

Given,

current dividend, D₀ = $3.80, g₁ = g₂ = g₃ = 15%,

g = 5% and required return, k = 16%

Expected dividend, D₁= D₀ x (1 + g₁)

= $3.80 x (1.15) = $4.37

Expected dividend, D₂ = D₁ x (1 + g₂)

= $4.37 x (1.15) = $5.026

Expected dividend, D₃ = D₂ x (1 + g₃)

= $5.026 x (1.15) = $5.779

Expected dividend, D₄ = D₃ x (1 + g)

= $5.779 x (1.05) = $6.068

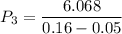

The price at the end of year 3, P₃ is

P₃ = $55.166

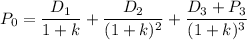

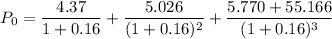

The current share price, P₀is

P₀ = $46.54