Answer:

Ans.

a) NPV = $3,901.89 if the discount rate was 9%

b) NPV = $3,232.33 if the discount rate was 17%

c) NPV = $2,841.47 if the discount rate was 23%

Step-by-step explanation:

Hi, we need to use the following equation in order to find the NPV for all the questions, the only thing that is changing is the discount rate, the equation is:

Now, let´s start solving.

a) when r = 0.09 (or 9%)

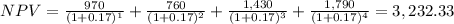

b) when r = 0.17 (or 17%)

c) When r = 0.23 (or 23%)

Best of luck.