Answer:

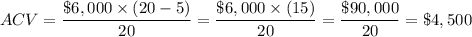

ACV=$4,500

Explanation:

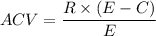

We have that the actual cash value (ACV) is defined as:

Where:

actual cash value

actual cash value

replacement cost or purchase price of the item

replacement cost or purchase price of the item

expected life of the item

expected life of the item

current life of the item

current life of the item

Then we have R=$6,000, C=5years, and to find the expected life of the item we can use the depreciating of the roof, then if the roof is depreciating $200 each year we just need to divide $4,000 by $200 to find the expected life of the roof:

Then the espected life of the roof is 20 years, with this result we have all the data, then:

Then the ACV is $4,500