Answer:

Intrinsic value: 53.41 dollars

Step-by-step explanation:

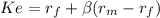

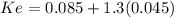

First, we use the CAPM model to know the value of the stock

risk free 0.085

premium market =(market rate - risk free) = 0.045

beta(non diversifiable risk) 1.3

Ke 0.14350

Now we need to know the present value of the future dividends:

D0 = 2.8

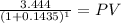

D1 = D0 x (1+g) = 2.8 * 1.23 = 3.444

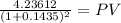

D2 3.444 x 1.23 = 4.2361200

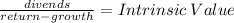

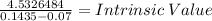

The next dividends, which are at perpetuity will we solve using the dividned grow model:

In this case dividends will be:

4.23612 x 1.07 = 4.5326484

return will be how return given by CAPM and g = 7%

plug this into the Dividend grow model.

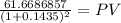

value of the dividends at perpetity: 61.6686857

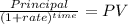

FInally is important to note this values are calculate in their current year. We must bring them to present day using the present value of a lump sum:

3.011805859

3.239633762

47.16201531

We add them and get the value of the stock:

53.413455