Answer:

before adjustment:

HRI 13%

LRI 15.8%

difference 2.8%

after adjustment

HRI 10.5% ↓2.5%

LRI 12.9% ↓2.9%

difference 2.4%

Step-by-step explanation:

we will valuate the CAPM for both companies:

before adjustment

risk free 0.06

market rate 0.13

premium market =(market rate - risk free) 0.07

LRI: beta(non diversifiable risk) 1

LRI Ke 0.13000

HRI ke: beta(non diversifiable risk) 1

HRI Ke 0.15800

With the changes:

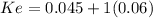

risk free 0.045

market rate 0.105

premium market =(market rate - risk free) 0.06

LRI: beta(non diversifiable risk) 1

LRI Ke 0.10500

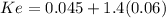

HRI beta(non diversifiable risk) 1.4

HRI Ke 0.12900