Answer: $150,300 (overallocated)

Step-by-step explanation:

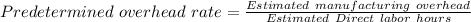

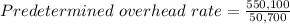

= $10.85 per direct labor hour

Applied overhead = Predetermined overhead rate × Actual direct labor hours

= $10.85 × 60,000

= $651,000

Manufacturing overhead overallocated = Applied overhead - Actual manufacturing overhead cost

= $651,000 - $500,700

= $150,300