Answer:

Option B is correct, that is It was greater than 18.96% whether interest was compounded daily or monthly.

Explanation:

Given: APR of Madeline's Credit Card = 18.96 %

We need to find effective Interest rate of Madeline's credit card when compounded daily or compounded monthly.

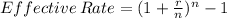

Formula for Effective Interest is,

where, r is normal rate and n is number of periods.

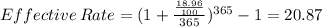

When rate is compounded daily,

we have, r = 18.96% and n = 365

%.

%.

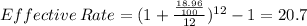

When rate is compounded monthly,

we have, r = 18.96% and n = 12

%.

%.

Therefore, Option B is correct, that is It was greater than 18.96% whether interest was compounded daily or monthly.