Answer:

$178,000

Explanation:

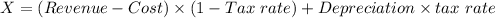

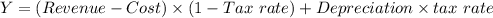

The calculation of X and Y is shown below:-

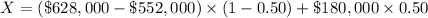

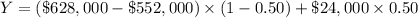

Before that we need to do the following calculations

= $180,000

= $24,000

Now, Operating cash flow of X in Year 1

= $38,000 + $90,000

= $128,000

and Operating cash flow of Y in Year 4

= $38,000 + $12,000

= $50,000

= $128,000 + $50,000

= $178,000

hence, the X + Y is $178,000