Answer:

a. 6% one is better

b. $12,285.95

Explanation:

a. For determining which investment earn more first we have to calculate both the investment which are as follows

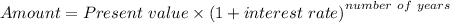

a. Based on compound quarterly, the amount is find out by using the following formula

where,

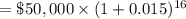

Present value is $50,000

Interest rate is =

= 0.015

= 0.015

And, the number of years is

=

= 16

So, the amount is

= $63,449.28

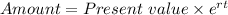

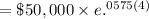

And, based on compounded continuously, the amount is determined by using the following formula

= $51,163.33

Therefore, The the investment at 6% is better

b. Now the difference in earning is

= $63,449.28 - $51,163.33

= $12,285.95