Answer:

The correct answer is: 70%.

Step-by-step explanation:

According to the information in the case:

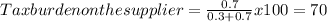

- Price elasticity of supply: 0.3

- Price elasticity of demand: 0.7

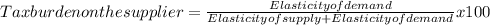

The percentage of the tax burden on the supplier is calculated in the following way:

Therefore, the tax burden on the supplier is 70%.