Answer:

The expected real rate of return for this investment is -0.21 or -21%

Step-by-step explanation:

= 241,

= 241,

= 358, nominal rate of return = 5% = 0.05

= 358, nominal rate of return = 5% = 0.05

Calculating for inflation rate, we have:

Inflation rate (IR) =

* 100% =

* 100% =

* 100%

* 100%

IR = 32.68% ≈ 33% or 0.33

Calculating for inflation rate, we have:

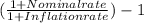

Real rate of return =

RR =

=

=

RR = -0.21 or -21%

The investment loses value over the next 20 years