Answer:

1. What is the TYM? 7.64%

2. What is the YTC?: 7.36%

3. 3. If interest rates are expected to remain constant, what is the best estimate of the remaining life left for RTE Incs bonds? : 8 yrs

As the YTC is lower than YTM the company will purchase the bonds

4. If RTE issued new bonds today, what coupon rate must have to be issued at par? 7.64%

The bonds will need to be issued at market to be at par.

Step-by-step explanation:

We solve for the YTM and YTC considering they are the sum of the coupon payment and maturity or call price which maches the current market price:

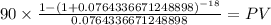

YTM

C 90.000

time 18

rate 0.076433667

PV $864.7491

Maturity 1,000.00

time 18.00

rate 0.076433667

PV 265.60

PV c $864.7491

PV m $265.6006

Total $1,130.3497

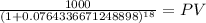

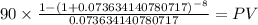

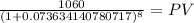

YTC

C 90.000

time 8

rate 0.073634141

PV $529.9297

Maturity 1,060.00

time 8.00

rate 0.073634141

PV 600.42

PV c $529.9297

PV m $600.4203

Total $1,130.3500