Answer:

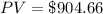

- A) Present value = $ 904.66

- B) Future value = $ 1,357.65

Step-by-step explanation:

A) Present value

You must discount each cash flow (payment) according to the moment when it is paid, at the same rate of return of other investments fo equal risk: 7%.

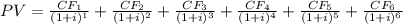

Thee formula that you must use is:

Where PV is the present value; CF₁, CF₂, CF₃, CF₄, CF₅, and CF₆ are the cash flows of the years 1, 2, 3, 4, 5, and 6 respectively, and i is the annual return.

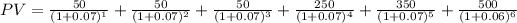

Substituting:

Computing:

B) Future value

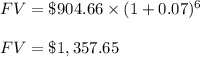

The formula for future value is:

Where, FV is the future value to calculate; PV is the present value already calculated, r is the rate of return, 7% = 0.07); and t is the number of periods, 6 years.

Substituting and computing: