Answer:

$722444.49386776

Explanation:

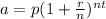

Use Compound Intrest Formula

- where p is the original amount.

- R is the amount of percentage compounded

- N is amount of times compounded per year.

- T is how long the interest last.

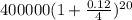

P is 400,00p

T is 12% or 0.12

N is 4 since it is compounded quarterly

T is 5.

Plug the values in

Ypu get

$722444.49386776