The correct answer is a increase of 28%

To solve this, we need to calculate the percentage increase between two numbers.

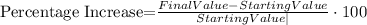

We can do this by using the formula:

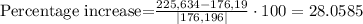

In this case, the Starting Value is the total in her account without the contrubution of the employer: $176,196.00

The Final Value is the total amount with the contribution of the employer: $225,634.00

Then:

Rounded up is 28%