ANSWER

Step-by-step explanation

To solve this problem, we have to apply proportions of the tax to the value of the property.

Since the tax rate is the same, it implies that the proportion for the two properties must be equal.

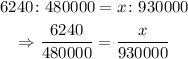

Let the tax on the second property be x.

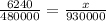

To find the proportion, find the ratios of the taxes to the values of the houses and equate them:

That is the correct proportion.