Let's begin by identifying key information given to us:

Income = $2,483

Social Security tax rate (for the employee) = 6.2% = 6.2/100 = 0.062 (based on the current tax regime)

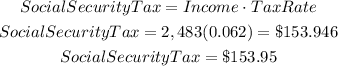

Social Security tax is given by the product of Monica's income & the social security tax rate. We have: