Morley's deductible amount from the losses, based on the 2020 tax rules, would be $6,000. This is calculated by taking the personal casualty loss after the $100 floor, which is $9,000, and subtracting 10% of his AGI ($3,000). The remaining deductible loss is $6,000.

To determine Morley's itemized deduction from the losses in the scenario given, we should follow the tax rules relevant to the year 2020. Here is a step-by-step calculation:

Step 1: Loss from Damage to Rental Property

- The loss from damage to rental property is generally deductible against rental income. If there is no rental income, or the loss exceeds the income, it can be carried forward or back, depending on the tax laws in effect.

Step 2: Loss from Theft of Bonds

- Losses from theft are deductible in the year the theft was discovered, provided there is no reasonable prospect of recovery. The amount of the loss is typically the adjusted basis of the stolen property, since personal items are usually not appreciated assets.

Step 3: Personal Casualty Gains and Losses

- Calculate net casualty loss. If personal casualty gains exceed personal casualty losses, the gains offset the losses.

- For personal casualty losses in a federally declared disaster area, you can deduct personal casualty losses that exceed $100 per casualty event.

Step 4: Deductible Casualty Loss

- Personal casualty losses are deductible to the extent that they exceed 10% of AGI plus $100 for each casualty event. The $100 is already accounted for in the "after $100 floor" figure.

Here’s how the calculation would work:

1. **Personal Casualty Loss Deduction Calculation**:

- Subtract 10% of AGI from the personal casualty loss.

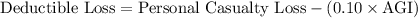

-

2. Net Personal Casualty Loss

- If there is a personal casualty gain, subtract it from the personal casualty loss after applying the $100 floor and 10% of AGI rule.

Now let's perform the calculations.

Morley's deductible amount from the losses, based on the 2020 tax rules, would be $6,000. This is calculated by taking the personal casualty loss after the $100 floor, which is $9,000, and subtracting 10% of his AGI ($3,000). The remaining deductible loss is $6,000.

This does not include the loss from damage to rental property or the loss from theft of bonds because these are typically deductible against income from those sources, and there is no information provided about such income. If there were rental income or income from bonds, those losses would be deductible against that income, potentially increasing the deductible amount.

the complete Question is given below: