(i) Monthly basic salary and taxable income:

Monthly basic salary =

Dearness allowance =

Total monthly income = Monthly basic salary + Dearness allowance

=

=

Dashain allowance = Monthly basic salary =

Total monthly income with Dashain allowance = Total monthly income + Dashain allowance

=

=

Contribution to EPF =

of Monthly basic salary

of Monthly basic salary

=

=

Life insurance premium =

Taxable income = Total monthly income with Dashain allowance - Contribution to EPF - Life insurance premium

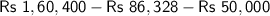

=

=

Therefore, the monthly basic salary is

and the taxable income is

and the taxable income is

.

.

(ii) Total income tax paid:

Social security tax =

Tax on income of Rs 6,00,000 =

Tax on income of Rs 2,00,000 =

of Rs 2,00,000

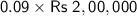

of Rs 2,00,000

=

=

Tax on income from Rs 2,00,001 to Rs 3,00,000 =

of Rs 1,00,000

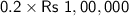

of Rs 1,00,000

=

=

Total income tax = Social security tax + Tax on income of Rs 2,00,000 + Tax on income from Rs 2,00,001 to Rs 3,00,000

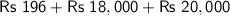

=

=

Therefore, the total income tax paid by him is

.

.

♥️