Final answer:

The present value of $300,000 can be calculated using the present value formula and is $79,361.01. Therefore, if you can earn 11% on your money, you should choose the option of $100,000 today.

Step-by-step explanation:

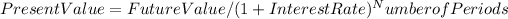

In order to determine whether to choose $100,000 today or $300,000 in 13 years, we need to compare the present value of the two options. The present value of $300,000 can be calculated using the present value formula:

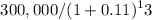

Using an interest rate of 11% and 13 periods, the present value of $300,000 is:

Present Value =

= $79,361.01

Therefore, if you can earn 11% on your money, you should choose the option of $100,000 today, as it has a higher present value than $300,000 in 13 years.