Final answer:

The present value of the bond is $1,145.44.

Step-by-step explanation:

The present value of a bond can be calculated by discounting the future cash flows back to the present using the interest rate. In this case, the bond pays $60 in coupon payments at the end of each year for 3 years and an additional $1,200 at the end of the third year. The interest rate is 7%. To calculate the present value, we need to discount each cash flow using the interest rate:

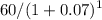

1st year coupon payment =

= $55.85

= $55.85

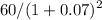

2nd year coupon payment =

= $52.31

= $52.31

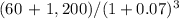

3rd year coupon payment + principal =

= $1,037.28

= $1,037.28

The present value is the sum of these discounted cash flows:

Present value = $55.85 + $52.31 + $1,037.28 = $1,145.44