You might have lacking given information so you can re-check the given.

You are lacking the value of L (life of the car in years).

There are several types of depreciation formulas. The straight-line method, sinking fund method, declining balance and double-declining balance. For the other methods you can search it up.

I used the sinking fund method for this case:

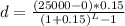

d = \frac{(25000 - 0)*0.15}{(1+0.15)^{L} -1

where d is the annual cost of depreciation

Co is the original cost,

is the value at the end of the life of object or salvage value

is the value at the end of the life of object or salvage value

L is useful life of the property

and i is the interest rate.

The salvage value can be assumed as zero in this case, therefore,

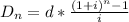

In solving for the expected depreciation one can use this formula:

where n is the number of years of the expected depreciation

D_n is the depreciation up to the number of years (n)