Answer:

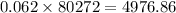

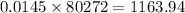

The deduction for social Security tax is $4976.86 and the deduction for Medicare tax is $1163.94 .

Explanation:

Marika Perez’s gross biweekly pay is $2,768. Her earnings to date for the year total $80,272.

What amount is deducted from her pay for Social Security taxes if the rate is 6.2%?

dollars

dollars

What amount is deducted for Medicare, which is taxed at 1.45%?

dollars

dollars