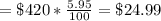

Your take home pay is $270.48

Step-by-step explanation

Your gross earnings per week is $420

You pay social security taxes of 7.65%, federal taxes of 22% and state taxes of 5.95%

So, the amount of social security taxes

the amount of federal taxes

and the amount of state taxes

Thus, the total amount of tax deducted from the gross earnings

So, your take home pay will be: