Answer:

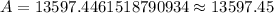

$13597.45

Explanation:

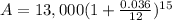

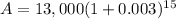

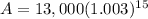

We have been given that Ichiro took out a subsidized student loan of $13,000 at a 3.6% APR, compounded monthly, to pay for his last two semesters of college.

Let us find the amount Ichiro will owe if he starts to paying off the loan in 15 months, using compound interest formula.

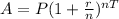

A=Amount after T years.

P= Principal amount.

r= Annual Interest rate (in decimal form).

n= Number of times compounded per year.

T= Time in years.

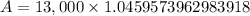

Upon substituting our given values in compound interest formula we will get,

Therefore, Ichiro will owe $13597.45, when he begins to paying off the loan after 15 months.