Answer: $2,800

Explanation:

Given: The assessment value of Jerome's home=

We know that to calculate the property tax, we need to multiply the assessment value of the property by the mill rate and then divide by 1,000.

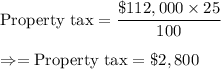

Then, the property tax is given by :-

Therefore, Jerome pay $2,800 as property tax in this year.