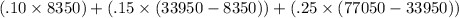

10 percent is the same as saying 0.10 so we simply do this sum of all parts approach.

You should get an answer a bit over 15000 if you plug it into your calculator. Remember, you are taxing a certain amount of dollars at each percentage so don't get hung up on the structure of the taxes. This is why we are subtracting the smaller number from the bigger