Answer:

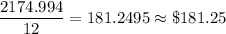

Angela will receive $181.25 in every paycheck.

Explanation:

We are given the following information:

Number of hours Angela work = 18 hours per week

Number of weeks Angela work = 12

Money earned per hour = $13

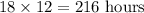

Total number of hours worked =

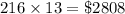

Money earned =

Money reduced:

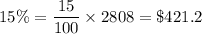

Money taken due to federal income tax =

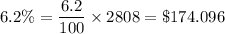

Money taken due to social security =

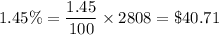

Money taken due to medicare =

Money left = 2808 - (421.2 + 174.096 + 40.71) = 2174.994

Money received in one paycheck =