Answer: The company's current sales is 9,333 units.

It has to sell a total of 10,695 units in order to achieve a target pre tax income of $1,125,000.

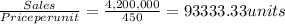

First we calculate the number of units sold at the current sales level.

We compute this as:

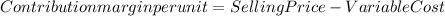

Next we find the contribution margin per unit.

Contribution Margin per unit is $180.

Flannigan Company's current per-tax income is calculated as :

Sales 4200000

less:Variable costs @ $270 for 9333.33 units -2520000

Contribution 1680000

less:Fixed Costs -800000

Pre tax income 880000

With this information, we can calculate the Contribution Margin required if the pre tax income should be $1,125,000. We work backwards in order to find the Contribution Margin from Pre-tax income.

Targeted Pre Tax income $1,125,000

Add: Fixed Costs $ 800,000

Contribution Margin $1,925,000

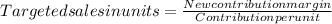

Since we know the per unit contribution, we can calculate the number of units to be sold as:

Since products can't be sold in parts, any decimal value after a whole number will be rounded up. Hence the targeted sales will be 10,695 units.