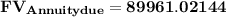

Answer: Dwayne's investment will be worth $89,961.02 after the last annuity payment is made.

Since Dwayne contributes $4700 at the beginning of each year, we need to calculate the future value of an annuity due.

We use this formula for our calculations:

![\mathbf{FV _(Annuity due) = PMT * \left [ ((1+r)^(n)-1)/(r) \right ]*(1+r)}](https://img.qammunity.org/2019/formulas/business/college/oxu5ab18sehxknn5vdsgujunrfaf7aid5u.png)

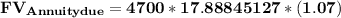

Substituting the values we get,

![\mathbf{FV _(Annuity due) = 4700 * \left [ ((1+0.7)^(12)-1)/(0.07) \right ]*(1+0.07)}](https://img.qammunity.org/2019/formulas/business/college/j0pvz6bg0dv3lcdyjpvnu8i4rdgnj2p104.png)

![\mathbf{FV _(Annuity due) = 4700 * \left [ \frac{2.252191589}-1}{0.07} \right ]*(1.07)}](https://img.qammunity.org/2019/formulas/business/college/3qktwjv5agrg4octhx8h8yfgy4piy8v9ai.png)

![\mathbf{FV _(Annuity due) = 4700 * \left [ \frac{1.252191589}}{0.07} \right ]*(1.07)}](https://img.qammunity.org/2019/formulas/business/college/uz4w94ztzw22hqhkvhrpdpgxh7x4njhi4d.png)