Answer:

A) $ 456.85

B) 0.25% per month

C) $ 429.812

Step-by-step explanation:

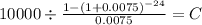

We solve for the quota of an annuity of 10,000 dollar over two year with a discount rate of 6% compounded monthly

PV 10,000

time 24

rate 0.0075

C $ 456.847

b) we need to remove the inflation premium to the 9% compounded monthly

0.09/12 - 0.005 = 0.0075 - 0.005 = 0.0025

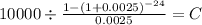

c) we should discount this at the real rate

PV 10,000

time 24

rate 0.0025

C $ 429.812