Answer:

23.56

Step-by-step explanation:

Standard deviation of the first stock (σ1) = 20%

Standard deviation of the second stock (σ2) = 37%

The correlation coefficient between the returns (ρ) = 0.1.

Proportion invested in the first stock (W1) = 43%

Proportion invested in the second stock (W2) = 57%

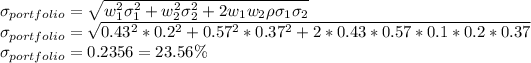

The standard deviation of a two-stock portfolio's returns is given by

The standard deviation of this portfolio's returns IS 23.56%