Answer:

3.85 years

Step-by-step explanation:

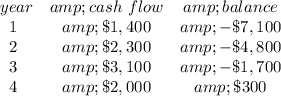

The payback period is the time that a company takes to recover its initial investment. Considering an initial investment of $8,500, and that cash flows are evenly distributed within each year, the payback period can be found by:

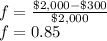

The payback period occurs sometime between years 3 and 4. The fraction of year 4 needed to reach payback is:

The company needs 3 years and 0.85 of the fourth year to break even. Therefore, the payback period for Vulcan Materials Company is 3.85 years.