Answer:

A. 16.71%

Step-by-step explanation:

Use dividend discount model (DDM) to solve this question.

Formula for finding the required return of a stock is;

r =

where P0 = Current price = $17.50

D1 = Next year's dividend = $3.45

r= required return = ?

g= growth rate = -3% or -0.03 as a decimal (negative sign is because dividend is expected to decrease)

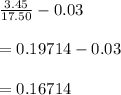

r =

As a percentage , it becomes 16.71%