Answer:

The constant percentage to be applied against book value each year is 40%

Step-by-step explanation:

Data provided in the question:

Cost of the equipment purchased by the company = $41,000

Estimated a salvage value = $8200

Useful life = 5 years

Now,

Under the double-declining-balance method,

the percentage rate of depreciation is given as;

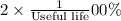

=

thus,

for Useful life of 5 years, we have

the percentage rate of depreciation =

or

the percentage rate of depreciation = 0.4 × 100%

or

the percentage rate of depreciation = 40%

Hence,

The constant percentage to be applied against book value each year is 40%