Answer:

No, he is wrong.

Explanation:

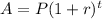

Since, the total payment of a loan after t years,

Where,

P = present value of the loan,

r = rate per period ,

n = number of periods,

Given,

P = $165,000,

In loan 1 :

r = 3% = 0.03, t = 15 years,

So, the total payment of the loan is,

In loan 2 :

r = 4% = 0.04, t = 30 years,

So, the total payment of the loan is,

Since,

Hence, total amount repaid over the loan will be less for Loan 1.

That is, the friend is wrong.