Answer:

0.143 or 14.3%

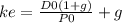

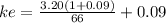

Step-by-step explanation:

Tax does not affect the Cost of common stock (Ke) since Dividend is an item of appropriation and not charge against profit.

Annual dividend, D0 = $3.20 per share

Dividends and earnings should grow, g = 9% annually

Selling price of common stock = $66

= 0.053 + 0.09

= 0.143 or 14.3%