Answer:

a) The value of the bond immediately after a payment is made is $3.750.

b) The value of the bond immediately before a payment is made is $4050.

Step-by-step explanation:

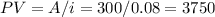

a) The value of the bond after a payment is made is equal to the value of the bond when it is issued at year 0.

As the bond pays interest forever, the present value can be calculated with the perpetuity formula:

The value of the bond immediately after a payment is made is $3.750.

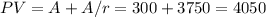

b) The value of the bond immediately before a payment is made can be expressed as the sum of these two terms:

1. The interest payment ($300)

2. The value of the bond after a payment is made ($3750)

The value of the bond immediately before a payment is made is $4050.