Answer:

EPS = $ 2.00

Step-by-step explanation:

Earning per share: EBIT/outstanding shares

unlevered firm EPS:

oustanding shares: 10,000

Levered firm EPS:

(EBIT - interest)/outstanding shares

where:

Interest_ 50,000 x 5% = 5,000

Shares repurchase: 50,000 / 20 = 2,500

Outstanding shares: 10,000 - 2,500 = 7,500

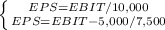

EBIT/10,000 = (EBIT-5,000)/7,500

(0.75)EBIT = EBIT - 5,000

5,000 / (1-0.75) = EBIT

EBIT = 20,000

EPS: 20,000 / 10,000 = 2.00